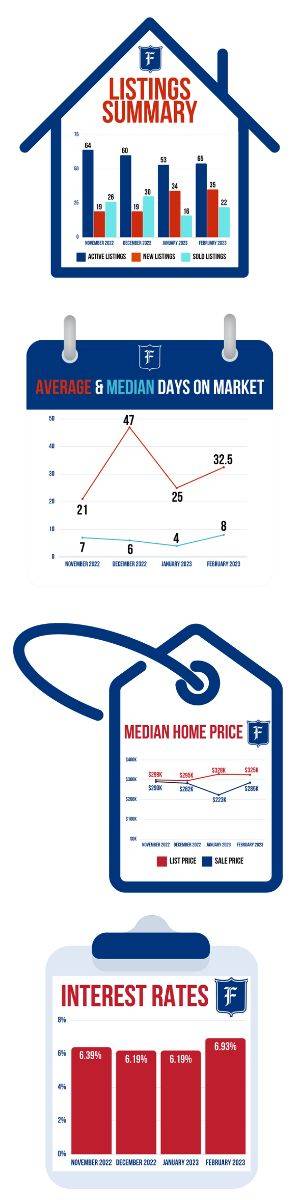

Interest rates jumped to the highest we’ve seen since October of 2022, but that did little to slow the Ames real estate market. Still, interest rates and a macro lens on the economy are something to monitor as interest rates can determine affordability for many buyers.

“A promising January, with mortgage rates falling to 6.1%, was followed by an unfavorable February, with rates moving up again,” said Nadia Evangelou, the National Association of Realtor’s senior economist. “What should we expect from mortgage rates this month (March)? It all comes down to inflation. If inflation moves below expectations, this could make mortgage rates come down to the low range of 6%. However, as of today (March 1st), the 10-year Treasury yield rose further to 4.01% from 3.93% the previous week.”

Despite the interest rate jump, as we’ve seen for the last two-plus years, homes that get listed often don’t last long. The median days on market in February was just over a week. We also saw active, new and sold listings all continue to increase, which is a positive sign. We’d like to see those numbers take a bigger step forward as we enter the spring and summer months, but the trend is encouraging.

After an outlier dip of median sale price in January, February's median sale price was in line with what we’d expect to see, helping prove that January was an anomaly.

More houses are needed to help ease the lack of inventory, so if you’ve thought about selling, reach out to your Friedrich and let them assist and serve you.

|